PM Lee, the financial planner

The Straits Times, 18 Aug 2014

Prime Minister Lee Hsien Loong on Sunday tackled criticisms of the Central Provident Fund head-on but with good humour, role-playing a financial planner to a fictitious Mr Tan and advising him on his retirement options.

The Straits Times, 18 Aug 2014

Prime Minister Lee Hsien Loong on Sunday tackled criticisms of the Central Provident Fund head-on but with good humour, role-playing a financial planner to a fictitious Mr Tan and advising him on his retirement options.

Mr Lee, who roled-played a housing agent at last year's National Day Rally, quipped: “Last year, I was your real estate agent. This year, the real estate market is no good. I have upgraded myself and become a financial planner.”

Explaining the rationale behind the increase in CPF's Minimum Sum, Mr Lee played "financial planner" to a hypothetical Mr and Mrs Tan, aged 54, with a monthly income of $4,500.

He asked the audience how much this couple would need in retirement: $1,000, $2,000 or $3,000 a month. Most said $2,000.

Mr Lee then used Mr Tan's case to explain how the Minimum Sum of $155,000 was "far from excessive" and might even be insufficient.

Lease Buyback Scheme extended to 4-room flats

The Housing and Development Board will extend the Lease Buyback Scheme to 4-room flats. This will enable more Singaporeans to monetize their assets and derive a steady stream of income for their retirement needs.

By Wong Siew Ying, Channel NewsAsia, 17 Aug 2014

The Housing and Development Board will extend the Lease Buyback Scheme to 4-room flats. This will enable more Singaporeans to monetize their assets and derive a steady stream of income for their retirement needs.

By Wong Siew Ying, Channel NewsAsia, 17 Aug 2014

"Last year, I was your real estate agent. This year, the real estate market is no good, I have upgraded myself, I have become a financial planner," quipped Prime Minister Lee as he spoke on retirement adequacy for Singaporeans in his National Day Rally on Sunday (Aug 17).

Mr Lee says Singapore has good schemes to provide assurance in retirement - namely through the Central Provident Fund (CPF) and home ownership. CPF members set aside the Minimum Sum when they turn 55 years old, and it will offer a regular stream of income for them after they turn 65. The payout will go on for as long as they live. The Minimum Sum for those who turn 55 this year is S$155,000. Mr Lee explained that the amount is "far from excessive".

CPF members can count their homes in the Minimum Sum, meaning they need to set aside just half of it in cash, which works out to S$77,500. Mr Lee conducted a poll of the audience at the Rally using an example of a fictitious couple Mr and Mrs Tan.

"I ask Mr Tan - how much do you think you will need in retirement every month?" Mr Lee said. "What do you think? S$3,000 per month? That's about two-thirds what he is getting now. S$2,000 per month - less than half what he is getting now? Or S$1,000 per month?"

"I ask Mr Tan - how much do you think you will need in retirement every month?" Mr Lee said. "What do you think? S$3,000 per month? That's about two-thirds what he is getting now. S$2,000 per month - less than half what he is getting now? Or S$1,000 per month?"

The majority picked S$2,000 a month. Mr Lee said this means the Tans will need S$250,000 for their retirement needs - which is more than the Minimum Sum. And if Mr and Mrs Tan pledged their home, the amount of S$77,500 kept in their CPF account would only give them S$600 a month. They would then need to find other sources of income to plug the shortfall.

Mr Lee said there are options to achieve this, including continuing to work, getting support from their children, tapping on savings or getting money of out their house.

For example, he could rent out a room for S$700 a month, or move in with his children and rent out the entire flat for S$2,500 a month.

"The third thing you could do is to 'right-size': sell this flat and buy a smaller flat. Let's say you buy a studio apartment, you move into the studio apartment and then in the process, you can enjoy a silver housing bonus from the Government which is S$20,000. We can do the sums, you get quite a lot of money - S$210,000, plus S$800 per month," explained Mr Lee.

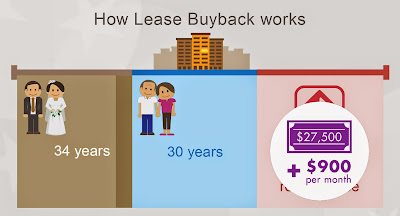

Another option is the Lease Buyback Scheme, which will be extended to 4-room flats. In Mr Tan's case - if he sells the remaining lease of 35 years to HDB - he will receive a lump sum of S$27,500 in cash, plus S$900 per month.

The Lease Buyback Scheme currently covers 3-room flats and below. Mr Lee says that extending it to 4-room flats will cover more than half of all flat owners in Singapore.

* Changes to Lease Buyback Scheme from 1 April 2015

3 questions and answers on the Minimum Sum and retirement

By Aaron Low, The Straits Times, 17 Aug 2014

By Aaron Low, The Straits Times, 17 Aug 2014

1) What will the Minimum Sum be for those turning 55 next year?

For those turning 55 from July 1 onwards, the Minimum Sum will be $161,000. This is up from the current $155,000 level this year.

The new Minimum Sum level does not apply to older cohorts who turned 55 earlier. CPF members who do not meet the Minimum Sum need not top up the shortfall in cash, or sell their property to meet the Minimum Sum.

The good news is that Prime Minister Lee Hsien Loong said that there will not be "any major increases in the Minimum Sum" beyond next year.

He did say that the MS will still be adjusted from "time to time", to cater for higher incomes and spending as well as to protect against longevity.

But chances are the future MS hikes are unlikely to be as high as they have been over the past decade or so, when the MS was on average going up at about 6 per cent a year.

2) Is it easy to achieve the new Minimum Sum level?

It depends very much on one's income and expenditure.

If a CPF member is highly paid, he will reach the Minimum Sum faster than a less-well paid member. Likewise, it also depends greatly on how much one spends. In this case, the big item for most people is housing.

A study conducted by two National University of Singapore academics Associate Professor Chia Ngee Choon and Associate Professor Albert Tsui in 2012 found that most young workers entering the job market today would not have much of a problem meeting the prevailing MS levels.

This is based on the assumption that they do not overspend on housing. For instance, buying a $1 million condominium when one's income is only $2,500 a month.

A similar study done by Lee Kuan Yew School of Public Policy economist Hui Weng Tat also showed that graduates earning about $2,500 who went on to buy a five room flat worth $560,000 will only get 22 per cent of their last drawn pay at age 62 in CPF payments.

3) If you can't meet the MS, what options do you have?

The easiest option would be to pledge your flat to meet up to half of the MS requirements. For people hitting 55 next year, that would mean pledging $80,500.

But doing that would mean that your monthly payouts from CPF Life when you hit 65 will be half of what you would get if you had kept to the full value of the MS.

Under the default CPF Life plan, you would get between $680 and $750 if you had pledged your flat for half the value of the $161,000 MS. And you would get between $1,240 and $1,372 if you met the full MS level.

Most financial planners would say that even if you had met your MS, it would be unwise to only depend on the CPF for retirement. And if you did not meet the MS, then it would be even more crucial to ensure other streams of income.

There are other ways to supplement your CPF payouts to provide for a more comfortable retirement:

1) Continue to work beyond the retirement age of 65. PM Lee said the Government will look to extend the re-employment age.

2) Depend on your children to support you.

3) Draw on personal savings.

4) Monetise your assets, such as your flat.

This can be done by renting out a room in your flat, or renting the whole flat out.

Or you could sell your flat and buy a smaller apartment which would free up cash.

The Government is also looking to extend a programme which allows older Singaporeans to sell part of the lease of their HDB flats back to the Government.

The Government will pay them a sum of money which can be used for their retirement. The Lease Buyback Scheme also allows Singaporeans to continue staying on in their flat.

PM Lee said that this scheme will now be extended to four-room flats. In all, the expanded Lease Buyback will cover half of all flat owners in Singapore.

Related

No comments:

Post a Comment