$11 billion set aside to fight COVID-19, $24 billion to help Singapore emerge stronger from crisis

DPM Heng Swee Keat unveils Budget to tackle current crisis, with eye on future challenges as well

By Linette Lai, Political Correspondent, The Straits Times, 17 Feb 2021

Against a backdrop of global uncertainty amplified by the pandemic, Deputy Prime Minister Heng Swee Keat yesterday delivered a Budget finely balanced between providing immediate help to sectors under stress, and investing in Singapore's long-term future.

The $107 billion plan - the first full Budget in the Government's new term - includes an $11 billion Covid-19 Resilience Package. This will help safeguard public health and support the workers and businesses that need help, with extra money going to the hardest-hit sectors, such as aviation and tourism.

The Jobs Support Scheme, which helped stave off retrenchments last year, will be extended until September, but in a more targeted and tapering way. This will cost $700 million.

Job seekers also got a helping hand, with another $5.4 billion set aside for a fresh injection into the SGUnited Jobs and Skills Package. This is on top of the $3 billion set aside last year and will support the hiring of 200,000 locals through the Jobs Growth Incentive and provide up to 35,000 traineeship and training opportunities this year.

In addition, Mr Heng pledged to allocate $24 billion across the next three years to enable Singapore's firms and workers to emerge stronger from the crisis.

The country's investments to equip its people to seize opportunities and help businesses innovate are what distinguish it from others, said Mr Heng, who is also Finance Minister.

"While last year's Budgets were tilted towards emergency support in a broad-based way, this year's Budget will focus on accelerating structural adaptions," he added in a speech that lasted just over two hours and underscored the need to make the country's businesses and workers future-ready.

Mr Heng announced that the salaries of nurses and other healthcare workers, who have been on the forefront of the fight against Covid-19, will be enhanced, with details to be disclosed later.

He also unveiled a $900 million Household Support Package of utility grants and GST and cash vouchers to help all families, but targeted most at lower-to middle-income households.

And in line with Singapore's long-term goal to become a more sustainable society, measures will be introduced to encourage the adoption of electric vehicles, with green bonds to be issued on select public infrastructure projects.

In a Facebook post last evening, Prime Minister Lee Hsien Loong said: "While grappling with the pandemic, we must not neglect the future. Hence the Budget has many items that build our capabilities and competitiveness. When the sun shines again, we must be ready to seize the new opportunities."

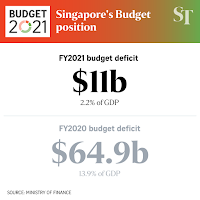

All these measures mean that Singapore will see a Budget deficit of $11 billion, following last year's deficit of $64.9 billion.

Running a fiscal deficit to support targeted relief is warranted in the immediate term, given the unprecedented impact of Covid-19, Mr Heng said. But Singapore's recurrent spending needs in areas such as healthcare will continue to rise, and the country must meet these needs in a "disciplined and sustainable way", he said, adding that beyond this crisis, "we must return to running balanced budgets".

Singapore will tap its reserves to fund the $11 billion Covid-19 Resilience Package. But Mr Heng pointed out that the nation expects to utilise only $42.7 billion of past reserves for the last financial year, against the $52 billion that had been provided for.

This means the total expected draw over two years will amount to $53.7 billion - a net increase of $1.7 billion from what Singapore expected to draw from its reserves to respond to the crisis. President Halimah Yacob has given her in-principle support for the draw, he added.

Singapore's spending needs mean the impending GST hike, slated to take place some time between next year and 2025, will happen "sooner rather than later". Its exact timing will depend on Singapore's economic outlook, Mr Heng said, adding that the country will not be able to meet rising recurrent needs without the increase. He reiterated that $6 billion has already been set aside under last year's Budget to defray the impact of this tax hike on the majority of Singaporean households by at least five years.

Petrol duties have also been raised for the first time in six years, and take place with immediate effect, with road tax rebates in place to cushion the impact of this hike.

From January 2023, GST will also be extended to low-value goods to ensure a level playing field for local businesses to compete effectively.

In order to finance long-term infrastructure such as new MRT lines that will benefit both current and future generations, the Government will also issue up to $90 billion in new bonds under a law to be tabled later this year.

On the topic of foreign manpower, Mr Heng said foreigners with the right expertise are a welcome complement to Singaporeans in areas where the country is short on skills. But foreign worker quotas will be tightened in the manufacturing sector, where the local workforce has to deepen its skills.

"The way forward is neither to have few or no foreign workers, nor to have a big inflow," he said. "We have to accept what this little island can accommodate."

Singapore expects its revenues will be able to support projected expenditure from all proposed measures as the economy recovers.

But this assumes the global Covid-19 situation comes under control by next year, said Mr Heng. Otherwise, the Government will seek the President's consideration to again tap past reserves.

"We have carefully thought through the different scenarios. While we expect recovery in Singapore and globally, there is a wide cone of uncertainty," he added.

"Even if the economic and fiscal situation turns out to be worse than expected, we must still press on to invest in new areas, so as to ride on the structural changes, transform and emerge stronger as an economy, and as a people."

Budget 2021: Six ways for Singapore to emerge stronger

In his Budget statement yesterday, Deputy Prime Minister and Finance Minister Heng Swee Keat outlined six ways in which Singapore can emerge stronger from the crisis. Rei Kurohi and Prisca Ang capture his key points.

The Straits Times, 17 Feb 2021

1 Boosting COVID-19 defences

Tackling the pandemic remains a key area of focus, and an $11 billion Covid-19 Resilience Package will focus on immediate and ongoing recovery efforts.

Of this sum, $4.8 billion goes towards public health and safe reopening measures, including testing, clinical management and contact tracing, and vaccination for everyone living in Singapore.

Another $700 million goes to extending the Jobs Support Scheme to help firms retain workers, but with support gradually tapering off.

The hardest-hit sectors, like aviation and tourism that now get 50 per cent wage support, will see this lowered to 30 per cent for April to June, and 10 per cent for July to September. Sectors like food services and retail, currently getting 30 per cent support, will see this reduced to 10 per cent for April to June.

The worst-hit sectors will continue to get more targeted support to preserve their capabilities, with an extra $870 million for the aviation sector.

Taxi and private-hire car drivers will be supported by the $133 million set aside for the Covid-19 Driver Relief Fund, and $45 million will be set aside for the extension of the Arts and Culture Resilience Package and the Sports Resilience Package.

2 Ramping up business innovation

Economic transformation is key to creating jobs and opportunities for Singaporeans, and $24 billion will be allocated over the next three years to help businesses and workers recover.

A key focus is restoring physical connectivity, and investments will be made in on-arrival testing and biosafety systems, such as the Notarise and Verify systems being developed by GovTech with the private sector to verify Covid-19 test results and vaccination records.

Businesses will also get support with innovating and collaborating beyond Singapore's shores through government investments in three platforms.

A pilot Corporate Venture Launchpad will co-fund corporates building new ventures, and an Open Innovation Platform will match companies and public agencies with solution providers and co-fund the prototyping of new systems, such as for monitoring workers' health. The Global Innovation Alliance will be enhanced to catalyse partnerships with major global innovation hubs, with the network of 15 cities currently growing to more than 25 over the next five years.

A Singapore Intellectual Property Strategy 2030 is also being developed to support businesses in commercialising their innovations.

The Government will also step up risk-sharing arrangements with providers of capital and give grants to support businesses to innovate, transform and scale up. Start-ups can tap enhanced support; mature enterprises, including SMEs, will get help co-funding the adoption of digital solutions and new technologies; and large local firms will be able to tap a new funding platform - that the Government and Temasek will each invest $500million in - to transform and expand.

3 Helping workers hone skills

An additional $5.4 billion will be allocated for the second tranche of the SGUnited Jobs and Skills Package to support the hiring of 200,000 locals this year and provide up to 35,000 training opportunities.

Of this, $5.2 billion goes to extending the Jobs Growth Incentive hiring window to end-September, to support companies in growth sectors, with more for those hiring mature workers, persons with disabilities and former offenders.

The SGUnited Skills, Traineeships and Mid-Career Pathways programmes will also be extended till March 31, 2022.

A new Innovation and Enterprise Fellowship Programme will support about 500 fellowships in areas like cyber security, artificial intelligence and health technology over the next five years.

Salaries will also be enhanced for nurses and other healthcare workers, and government support for wage increments for locals will be supported with the extension of the Wage Credit Scheme for a year.

The Capability Transfer Programme that supports the transfer of skills from foreign to local workers will also be extended till end-September 2024.

And to help the manufacturing sector skill up, the sub-dependency ratio ceiling for S Passes in the sector will be reduced from 20 to 18 per cent from January 2022 and to 15 per cent from January 2023.

4 Strengthening social cohesion

A $900 million Household Support Package will continue short-term relief for eligible households, including a one-off GST Voucher - Cash Special Payment of $200 in June, and a GST Voucher - U-Save Special Payment of $120 to $200 in April and July, or an additional 50 per cent, for eligible HDB households.

Service and conservancy charges rebates will also be extended for another year.

In addition, every Singaporean child below 21 will get a one-off $200 top-up to their Child Development Account, Edusave Account or Post-Secondary Education Account.

All Singaporean households will also get $100 in Community Development Council (CDC) vouchers to be used at heartland shops and hawker centres.

Looking further ahead, over $200 million more will go to supporting companies that raise their retirement and re-employment ages above the prevailing statutory ages, and that offer part-time employment to older workers who request it.

ComLink - which helps low-income families in rental housing - will be expanded significantly over the next two years to cover 14,000 families, up from 1,000 now. An Inclusive Support Programme will provide early intervention support for children with special needs.

To encourage charitable giving, the 250 per cent tax deduction for donations will be extended by two years, and $20 million will be set aside for a new Change for Charity Grant to match donations raised by businesses that encourage customers to donate while making purchases.

Another $50 million will be set aside for a matching grant for the CDC Care and Innovation Fund, to support bottom-up initiatives that address community needs.

5 Building a sustainable home

Following the launch of the Singapore Green Plan 2030 last week, $60 million will be set aside for a new Agri-Food Cluster Transformation Fund to lift productivity and food resilience.

Another $30 million will be set aside over the next five years to incentivise the switch to electric vehicles, including the installation of 60,000 charging points at public carparks and private premises by 2030. Electric cars will be made more affordable with the lowering of the additional registration fee floor from $5,000 to $0 from January 2022 to December 2023. Road tax bands will also be adjusted.

Petrol duties will also be raised by 15 cents per litre for premium grade petrol to 79 cents a litre, and by 10 cents a litre to 66 cents a litre for intermediate grade petrol.

The Government will take the lead on sustainability, by committing public agencies to more ambitious goals under the GreenGov.SG initiative, and issuing green bonds on select public infrastructure projects. Up to $19 billion worth of public sector green projects have been identified, including Tuas Nexus which will integrate waste and water treatment facilities.

A new Enterprise Sustainability Programme will also be launched to help enterprises use resources more efficiently and develop new green products and solutions.

Singaporeans with ideas for sustainable development are also encouraged to step forward and the Government will support ground-up projects.

6 Managing our finances

While this Budget will see an $11 billion draw on past reserves for FY2021 to fund the Covid-19 Resilience Package, the Government does not expect to use $9.3 billion of the $52 billion draw previously approved for FY2020.

Therefore, the total expected draw on the reserves over the two financial years totals $53.7 billion - or an additional $1.7 billion over what it expected to draw to respond to the crisis.

But Singapore's fiscal situation is expected to be tighter in the years ahead, and a few measures will be needed.

The hike in goods and services tax (GST) rate from 7 per cent to 9 per cent will be needed between 2022 and 2025, and sooner rather than later, subject to the economic outlook, if Singapore is to meet rising recurrent spending needs, especially in healthcare. Its impact will, however, be cushioned by the $6 billion Assurance Package announced in last year's main Budget.

At the same time, GST will have to be paid on lower-value goods bought online and imported by air or post from Jan 1, 2023, to ensure a level playing field for local businesses.

The Government also intends to issue new bonds under a proposed Significant Infrastructure Government Loan Act (SINGA) to finance major, long-term infrastructure investments that benefit current and future generations, such as MRT lines and infrastructure to protect against rising sea levels like tidal walls. The borrowing limit will be set at $90 billion as a safeguard.

And if the need arises, should the economic and fiscal situation turn out worse than expected, the Government will seek the President's consideration to use past reserves to support economic investments in new areas, as this will enable Singapore to ride on structural changes, transform and emerge stronger.

GST hike to 9% will happen between 2022 and 2025, 'sooner rather than later', says DPM Heng

By Lim Min Zhang, The Straits Times, 17 Feb 2021

The planned goods and services tax (GST) increase will take place between next year and 2025 - sooner rather than later and subject to the economic outlook, Deputy Prime Minister Heng Swee Keat said yesterday.

The planned hike, from 7 per cent to 9 per cent, was announced in Budget 2018. Mr Heng had said in last year's Budget that the hike would not kick in this year, in view of the economic conditions then.

That has not changed, he said in his annual Budget speech.

Without the increase, Singapore will not be able to meet its rising recurrent spending needs, particularly in healthcare, he said.

"While we are fortunate to be able to tap our reserves to respond to the Covid-19 crisis, it is not tenable for the Government to run persistent budget deficits outside periods of crisis," he said.

He reiterated the Government's commitment that the overall taxes and transfers system will remain "fair and progressive", with a previously announced $6 billion Assurance Package set aside to cushion the impact of the hike when it takes place.

The package will effectively delay the effect of the GST rate hike for the majority of Singaporean households by at least five years, he said. For lower-income Singaporeans, the offset will be higher, with those living in one-to three-room Housing Board flats receiving about 10 years' worth of additional GST expenses incurred, he added.

GST on publicly subsidised education and healthcare will continue to be absorbed fully.

No finance minister likes to talk about tax increases, especially with a raging pandemic going on, he said. "But we do this because we plan for the long term and do not shy away from explaining to fellow citizens why we need to make tough but necessary decisions to ensure we have enough to provide for our nation's future."

The country's fiscal situation is expected to get tighter in the coming years, he said. The Government had already expected a structural increase in recurrent spending needs before Covid-19, especially in areas such as healthcare.

Government spending on healthcare has tripled within a decade, from $3.7 billion in FY2010 to $11.3 billion in FY2019, he noted. "Singaporeans have often expressed the desire to better care for our seniors with quality yet affordable health and aged care services. This is possible only if we can muster the resources to do so," he said.

He added that Covid-19 has also raised the economic uncertainties for citizens and workers, which calls for stronger social safety nets to protect those who are disadvantaged or more vulnerable. This will mean higher recurrent spending going forward.

Mr Heng said the Government has maintained the principle that recurrent expenditure should be funded by recurrent revenue. This ensures that spending is responsible and fair for current and future generations.

The entire system of taxes and benefits is a progressive one, he added. Last year, the top 20 per cent of households by income paid 56 per cent of the taxes and received 11 per cent of the benefits, he said. The bottom 20 per cent paid 9 per cent of the taxes and received 27 per cent of the benefits.

On GST, he said that based on past collections, more than 60 per cent of net GST borne by households and individuals come from foreigners living here, tourists and the top 20 per cent of resident households. The last GST hike, from 5 per cent to 7 per cent, took effect in 2007.

Singapore to impose GST on low-value goods bought online imported by air or post from 2023

By Sue-Ann Tan, The Straits Times, 17 Feb 2021

Low-value goods bought online and imported by air or post will be subject to the goods and services tax (GST) from Jan 1, 2023.

Even non-digital services that are imported for consumers, such as those involving live interactions with overseas providers of fitness training, counselling and tele-medicine, will attract GST.

This will help level the playing field for local businesses to compete effectively, said Deputy Prime Minister Heng Swee Keat.

Low-value goods that are worth $400 or less, and imported via air or post, are currently not subject to GST to facilitate clearance at the border, but the tax is paid on such goods bought here.

All goods imported via land or sea are already taxed, regardless of value.

DPM Heng said yesterday: "One aspect of a fair and resilient tax system is ensuring a level playing field for our local businesses vis-a-vis their overseas counterparts. This is especially relevant as e-commerce for sales of goods and services is growing."

He noted that other jurisdictions have already implemented or announced plans to impose the equivalent of GST on such goods.

"Overseas suppliers of goods and services will be subject to the same GST treatment as local suppliers," he added.

This new taxation will be effected through the Overseas Vendor Registration regime, which requires overseas suppliers and electronic marketplace operators that make significant sales of digital services to local consumers to register for GST.

These registered suppliers and operators will then charge GST on their sales of low-value goods that are delivered over air or post to local consumers.

Shoppers will have to pay the GST when they buy from these overseas suppliers, just as they will be charged when they buy such items from local businesses.

Meanwhile, local GST-registered businesses here will have to self-account for GST when they import such goods as well and pay the tax.

GST was extended to cover all imported digital services in Budget 2018, and kicked off from Jan 1 last year. These include video and music streaming services, apps, software and online subscription fees.

Online sales made up 11 per cent of Singapore's total retail takings in December last year.

A spokesman for e-commerce platform Lazada said: "Lazada supports the Government's commitment to build a trusted e-commerce economy that protects the interests of consumers and businesses.

"We will comply with local tax regulations and collaborate with legislators on digital tax initiatives that equitably benefit all relevant stakeholders, including the small and medium-sized enterprises that sell on our platform."

Consumers and experts said this tax will not stop the online shopping trend, but will create a more level playing field for local and overseas sellers.

EY Asean indirect tax leader Yeo Kai Eng said: "GST will be an additional cost for online shoppers, but online shopping is also convenient and the prices can still be very attractive. It will not deter them."

Mr Lam Kok Shang, head of indirect tax at KPMG in Singapore, added: "With more businesses now gravitating away from selling via bricks-and-mortar means and moving onto online platforms or marketplaces, the imposition of GST on low-value goods places overseas sellers of goods and local businesses on a level playing field."

Ms Esther Yeoh, 25, a teacher, said: "There are companies in Singapore that try to produce those same goods or sell them, so it is a good thing to support local businesses and make it a habit."

Public healthcare workers to get pay rise

By Salma Khalik, Senior Health Correspondent, The Straits Times, 17 Feb 2021

Public healthcare workers will be getting an increase in their salaries soon.

This pay rise will apply across all public healthcare institutions, including hospitals and polyclinics, as well as publicly-funded long-term care service providers, Deputy Prime Minister Heng Swee Keat said yesterday.

Even support care staff can look forward to more take-home pay.

Paying tribute to these dedicated workers, Mr Heng said: "Our healthcare workers have, over the years, been working hard to provide us with the highest quality of care.

"Since Covid-19 hit, their exemplary commitment has shone through. Once again, let me express our deepest appreciation to all healthcare workers for your dedication in fighting the pandemic," he added.

But even beyond the pandemic, the healthcare sector is expected to continue to grow as the population ages.

It is a sector that provides many good skilled jobs "that are noble, meaningful, and make a difference to Singaporeans", said Mr Heng.

Details will be given during the debate on the Ministry of Health's budget for the year.

In 2014, nurses had their pay increased by between 5 per cent and 20 per cent, following recommendations by the National Nursing Taskforce.

At that time, Health Minister Gan Kim Yong had said: "Nurses play a very important role. They are on the front line; they are on the ground. They are the backbone of our healthcare workforce."

Doctors, dentists and allied healthcare professionals also received pay increases that year.

The pay for nurses went up again in 2015 to make the profession more attractive.

$11 billion Resilience package to help Singapore bounce back

Three-pronged approach will safeguard public health, and support workers, businesses and sectors under stress

By Salma Khalik, Senior Health Correspondent, The Straits Times, 17 Feb 2021

A total of $11 billion will be set aside for a Covid-19 Resilience Package which will support a three-pronged approach to help Singapore bounce back from Covid-19.

It will address immediate needs to safeguard public health and reopen the economy safely, support workers and businesses, and target specific sectors under stress, Deputy Prime Minister Heng Swee Keat said yesterday.

"The global economy is projected to recover to pre-Covid-19 levels this year, but the recovery is uneven across countries and sectors," he said.

"The Singapore economy is projected to grow between 4 per cent and 6 per cent, with some sectors growing well, and others remaining under stress."

The $11 billion will be used to support the recovery process.

Of this, $4.8 billion will go towards safeguarding public health, including providing everyone who is eligible with free vaccination against the virus.

The national vaccination programme and the medicines for those infected will cost $1 billion.

The bulk of the money allocated to public health - $3.1 billion - will be used for testing, clinical management of those who become sick, and contact tracing to identify people who might have become infected, to prevent spread and clusters forming.

Another $5 billion will be used to support workers and businesses, with the lion's share of $2.9 billion going to the Jobs Support Scheme.

Singapore has already committed $25 billion to this scheme, supporting more than 150,000 employers for up to 17 months.

Of the $2.9 billion allocated to the Jobs Support Scheme, $700 million was announced yesterday, while $2.2 billion had been promised in August last year.

Said Mr Heng: "As the situation improved, I tapered support for sectors that were recovering well, and extended support to harder-hit sectors."

The third tranche of $1.2 billion will be used to support specific sectors that have been especially badly hit by the fallout from the pandemic.

The aviation sector will get $870 million. Another $45 million will go towards helping the arts and culture, and sports sectors; and $133 million has been set aside for the taxi and private-hire car drivers under a relief fund announced in December. But these measures alone will not be enough to secure Singapore's future because "the Covid-19 pandemic has triggered global shifts on the economic, social and political fronts, on a scale arguably greater than the 1929 Great Depression".

"It has set off new domains for competition and cooperation," said Mr Heng, who promised to pump in $24 billion over the next three years to "enable our firms and workers to emerge stronger".

The changing competitive landscape, rising inequalities and importance of sustainability "are all mega-shifts, that will continue to reshape the world".

What will distinguish Singapore from other countries recovering from the pandemic are the investments in the future.

He said: "We will invest in our people, so they can bounce back and be ready for opportunities that arise; and we will invest in our businesses, so they can innovate, build deep capacities and seize growth opportunities.

"Singapore must never stop thinking of the future, even as we respond swiftly to meet current needs. This is how we stay exceptional, and staying exceptional is how we survive," he said.

Efforts will span several years and build on the transformation push started five years ago with the industry transformation maps.

The idea was for integration of the different restructuring efforts, and to deepen partnerships between Government and industry.

The maps span a diversity of activities from healthcare and education to transport, retail and manufacturing.

But the immediate focus, Mr Heng said, is to grow a vibrant business community, help businesses to transform and grow, create new opportunities and redesign jobs.

Jobs Support Scheme to be extended by up to 6 months

Up to 30% in subsidies for wages paid from April to Sept by firms in worst-hit sectors

By Hariz Baharudin, The Straits Times, 17 Feb 2021

Wage subsidies under the Jobs Support Scheme (JSS) will be extended by up to six months to help businesses that remain badly hit by the Covid-19 pandemic to retain workers, Deputy Prime Minister Heng Swee Keat said yesterday.

The subsidies - which range from 10 per cent to 30 per cent - will cover wages paid from April to September for companies in sectors worst hit by the crisis: aviation, aerospace and tourism.

For firms in other industries that have been hit hard, including food services, retail, marine and offshore, as well as arts and entertainment - the extension will be from April until June.

The new tranche of wage subsidies, which will cost the Government $700 million, will offer targeted support to sectors that continue to be hard hit, Mr Heng said in his Budget speech.

Under the scheme, the Government pays a portion of the wages of employees who are Singaporeans or permanent residents.

The tiered subsidies apply to the first $4,600 of gross monthly wages paid to each employee.

The co-payment is widely seen as the biggest lifeline for businesses and workers amid the pandemic.

With the new extension, firms in sectors that need the most support - aerospace, aviation and tourism - will receive 30 per cent of wages paid from April to June in September. They will also receive 10 per cent of wages paid from July to September in December.

Those in the next tier, which includes food services, retail, marine and offshore, as well as arts and entertainment, will receive 10 per cent of wages paid from April to June. They will receive this payout in September.

Mr Heng said: "Even as our economy recovers gradually and some sectors grow well, some other sectors remain stressed. I will tailor support to maintain resilience and support growing areas."

He added that over $25 billion has been committed to the JSS, which has supported more than 150,000 employers for up to 17 months.

The scheme, which was first introduced in the Budget in February last year, had subsidised between 25 per cent and 75 per cent of wages paid for 10 months.

It was to cover wages paid until August last year, with the final payout made last October.

But this was extended to offer additional payouts - between 10 per cent and 50 per cent of wages - in March and June this year for the relevant firms.

Mr Heng noted that the pandemic continues to affect many of Singapore's workers and businesses, and the JSS was introduced with a clear goal to protect jobs and help firms retain local workers.

As things got better for Singapore, the support was tapered off for sectors that were recovering well, while those harder hit received more help.

Mr Heng said the current tranche of subsidies will continue to cover wages up to next month for most sectors, and added that he was encouraged to see companies taking the initiative to upskill their workers.

"I am heartened that many employers have managed to retain and reskill their workers," he said.

Employers can refer to the Inland Revenue Authority of Singapore's JSS website for more details on the computation and payment schedule.

Aviation sector to get $870 million in additional support, extended cost relief

By Toh Ting Wei, The Straits Times, 17 Feb 2021

The aviation sector will get additional support and extended cost relief to the tune of $870 million, given that the volume of international air travel remains a tiny fraction of what it was.

The sector is expected to remain badly affected this year, and re-covery will take some time, Deputy Prime Minister Heng Swee Keat said yesterday.

The funding for the sector will come under the $11 billion Covid-19 Resilience Package.

Additional funding drawn from a separate $24 billion fund to help firms and workers emerge stronger will be invested in on-arrival testing and biosafety systems, said Mr Heng. This will help secure Singapore's position as a key aviation hub in which both travellers and employees trust.

"Airports will be differentiated by their capabilities in securing public health and enabling safe travel," Mr Heng added. "They will need digitalised systems and the ability to effectively reroute people and goods."

One example of work on this front is the Government Technology Agency's collaboration with Temasek-founded start-up Affinidi.

The two organisations are working together to develop software that can quickly verify digital Covid-19 test result certificates and vaccination records.

An app developed by Affinidi is now being trialled by Singapore Airlines (SIA) to verify health documents produced by travellers.

But Mr Heng cautioned that Covid-19 has reshuffled the global web of connectivity.

For example, the total number of passengers passing through Changi remains at about 2 per cent of pre-Covid-19 levels as at end-January.

"I expect the aviation sector to use this lull to sustain and upgrade its capabilities, and to prepare for the recovery," he added.

SIA said yesterday that the support measures will bolster its efforts to get through the pandemic, and thanked the Government for its support.

The land transport sector was also flagged for additional support by Mr Heng. He said $133 million has been set aside to continue with the Covid-19 Driver Relief Fund announced earlier.

Eligible drivers will get $600 a month from January to March this year, and $450 per month from April to June.

ADDITIONAL SUPPORT FOR ARTS AND CULTURE, SPORTS

The arts and culture as well as sports sectors have also been "deeply affected by the pandemic", Mr Heng said yesterday.

Hence, the Government will extend the Arts and Culture Resilience Package and Sports Resilience Package to support businesses and self-employed people in these sectors.

A sum of $45 million will be allocated to extend and enhance the support packages, said Mr Heng. He added that the enhancement will support capability development and sector transformation, among other goals.

"We look forward to activities resuming, with greater vibrancy."

More details will be disclosed next week when debate begins on each ministry's budget.

$24 billion to help firms, workers adapt to global changes

Funds will go towards business transformation and building vibrant innovation ecosystem

By Choo Yun Ting, The Straits Times, 17 Feb 2021

Around $24 billion will be spent over the next three years to help companies and workers adapt to changes in the global landscape brought on in part by the pandemic.

The funds will go towards building a more vibrant business sector and innovation ecosystem, helping businesses to transform and scale up their operations, and creating opportunities for workers.

Deputy Prime Minister Heng Swee Keat said yesterday that Singapore must deepen its position as a global-Asia node to emerge stronger from the Covid-19 crisis.

That will involve working to restore the country's physical connectivity with the rest of the world, expand its digital connectivity and deepen its capacity to collaborate and innovate with global partners.

PLATFORMS FOR INNOVATION

Singapore will invest in three platforms to help companies innovate and collaborate on a global scale, to help them remain competitive.

The Corporate Venture Launchpad will be piloted this year to drive innovative ventures, providing co-funding for companies to build new ventures through pre-qualified venture studios.

"This is especially useful for larger businesses which want to rekindle a start-up mindset within their organisations," Mr Heng said.

He noted how BCG Digital Ventures, a venture studio, has collaborated with food and agricultural giant Olam to build a farmer services platform.

The platform, Jiva, will help farmers in developing countries increase crop yield, access credit and connect directly with buyers.

The venture not only helps meet rising global food demand, but also uplifts farmers' incomes, Mr Heng said.

In addition, the Open Innovation Platform, a crowdsourcing initiative, will be enhanced to increase the speed and scale of digital innovation through new features such as a discovery engine.

This will enable the platform to make automated recommendations as it helps to match problems faced by companies and public agencies with solution providers.

The platform also co-funds prototyping and deployment of solutions.

Enhancements will also be made to the Global Innovation Alliance, which helps to catalyse cross-border collaboration between Singapore and major global innovation hubs.

The network has 15 links to cities, including Bangkok, Jakarta, London and San Francisco, and will be expanded to more than 25 cities over the next five years.

It will be given a boost by the Co-Innovation Programme, which will support up to 70 per cent of qualifying costs for cross-border innovation and partnership projects.

The Singapore Intellectual Property Strategy 2030 is also being developed to support companies in commercialising the fruits of their innovation and help them in areas such as protecting and managing their intellectual property.

Strong connectivity will help businesses plug into global and regional supply chains and industry clusters, and deepen innovation partnerships, said Mr Heng, who is also Finance Minister.

Singapore has been stepping up its connectivity with South-east Asian nations, he said, noting that the region has significant growth potential.

Among efforts to strengthen its links in the region is the inaugural South-east Asia Open Innovation Challenge, which was launched last December. It drew participation from companies in countries such as Indonesia and Thailand.

"We will continue to work closely with our Asean members, to enhance digital connectivity and cyber security, and to get ready for the fourth Industrial Revolution, building on initiatives such as the Asean Smart Cities Network," Mr Heng said.

Singapore will also continue to enhance its infrastructure investments in the region, through projects such as Nongsa Digital Park in Batam, which facilitates collaboration between Singapore companies and technology talent in Indonesia, he said.

Support for hiring of 200,000 locals this year under Jobs Growth Incentive

Extra $5.4 billion allocated for jobs, skills; up to 35,000 traineeship, training opportunities will be on offer too

By Calvin Yang, Correspondent, The Straits Times, 17 Feb 2021

The SGUnited Jobs and Skills Package is being revved up to support the hiring of 200,000 locals this year through the Jobs Growth Incentive, and provide up to 35,000 traineeship and training opportunities.

The initiative - launched last year to tackle the anticipated labour market fallout from the Covid-19 pandemic - is a key pillar in the country's industry transformation.

Almost 76,000 individuals had been placed in jobs, traineeships, attachments and skills training as at the end of last year.

The Jobs Growth Incentive, which encourages companies to bring forward recruitment through wage subsidies, led to the hiring of an estimated 110,000 local job seekers within two months of the scheme's implementation.

"Looking ahead, as companies and industries transform, and new growth areas emerge, our people will need to have the skills and agility to move. To emerge stronger, our people will need new knowledge and skills," said Deputy Prime Minister Heng Swee Keat yesterday.

An additional $5.4 billion will be allocated to a second tranche of the Jobs and Skills Package, on top of the $3 billion allocated last year.

The bulk of this - $5.2 billion - will be allocated to the Jobs Growth Incentive to extend the hiring window by seven months, to the end of September.

The extension will give firms hiring eligible locals up to 12 months of wage support from the month of hire, while those taking on mature workers, people with disabilities and former offenders will be given up to 18 months of enhanced wage support.

Support for other components under the Jobs and Skills Package, such as the SGUnited Skills, SGUnited Traineeships and the SGUnited Mid-Career Pathways programmes, will be extended for workers who require additional help before landing a job.

Mr Heng also announced that the National Research Foundation will be supporting about 500 fellowships under the Innovation and Enterprise Fellowship Programme over the next five years to meet the needs in areas such as cyber security, artificial intelligence and health technology.

It will work with a range of partners, including accelerators, venture capital firms and deep tech start-ups.

The minister said: "As we head into a more technologically intensive and innovation-driven economy, we must also groom leaders in innovation and enterprise, especially in deep technology areas."

He noted the importance of skilled human capital in Singapore's next phase of transformation: "Enabling our people to have access to good jobs and job opportunities is the purpose of developing a strong economy. A vibrant economy creates the jobs and opportunities for our people to be at their best."

He said the employment landscape is evolving, pointing out that a digital, innovation-driven economy means that businesses will need highly skilled workers and deep talent. Singaporeans, therefore, will need to have both broader and deeper skills and creativity.

Mr Heng also noted that the workplace is changing, with the pandemic forcing people to work from home and adopt new ways of collaborating with others.

However, he urged Singaporeans not to be fearful, adding: "There are many strengths in Singapore that will enable us to create good jobs here. But to access these, we have to learn and adapt."

Singapore households to get $900 million support package, including $100 CDC vouchers

It includes vouchers to help families defray expenses, as well as GST vouchers and S&CC rebates

By Yuen Sin, The Straits Times, 17 Feb 2021

A $900 million Household Support Package will be introduced for families amid the uncertain economic situation in the wake of the Covid-19 pandemic, Deputy Prime Minister Heng Swee Keat announced yesterday.

The package includes vouchers that each household can use to defray expenses and support local businesses, as well as service and conservancy charge rebates and goods and services tax (GST) vouchers.

About 1.3 million Singaporean households will receive $100 Community Development Council (CDC) vouchers that can be used at participating heartland shops and hawker centres. More details on this will be announced by the CDCs later. To fund this, an additional grant of $150 million will be provided to the CDCs.

Mr Heng said the move is not only to thank all Singaporeans for their sense of solidarity, but also to continue supporting heartland businesses and hawkers.

"Singaporeans' sense of unity and discipline in observing the precautionary measures such as safe distancing and mask wearing has enabled our progress so far in combating the pandemic. The discipline and understanding of our local merchants and hawkers have also been important.

"However, they have been quite affected by the safety measures, especially during the circuit breaker," he noted.

Eligible Singaporean households in Housing Board flats will also receive rebates to offset service and conservancy charges over the year, said Mr Heng.

About 950,000 Singaporean households will be able to receive these rebates, which will offset between 1½ and 3½ months of the charges, over four quarters - in April, July, October and January next year.

About 1.4 million lower-income Singaporeans will also get an additional GST Voucher - Cash Special Payment of $200 in June, on top of the regular GST Voucher cash payout.

About 950,000 households will also get additional utilities rebates of between $120 and $200 under the GST Voucher - U-Save Special Payment that will be credited in April and July. This means they will receive 1½ times their usual annual rebate.

Singaporean children below the age of 21 will also get an additional $200 top-up to their Child Development Account, Edusave account or Post-Secondary Education Account which can help fund education-related expenses. This will benefit about 780,000 children.

Mr Heng said the package comes on top of immediate relief and support measures introduced for families and workers over five Budgets last year, including the Solidarity Payment, Covid-19 Support Grant, Temporary Relief Fund and grocery vouchers for lower-income groups.

"This Household Support Package provides some support to all families, with lower-to middle-income families receiving more," he said.

Mr Heng also said Singaporeans have supported one another amid the pandemic, and stayed united in the face of adversity.

"Social cohesion does not happen naturally. Even before Covid-19, many societies were facing sharp divisions due to widening inequalities, increasing diversity of interests and voices, and growing distrust. The pandemic has deepened the cracks in many societies," said Mr Heng, adding that Singapore is not immune to these challenges.

"We must continue to strengthen our social fabric, and reject forces of division and discord."

New $60 million fund to boost food production by harnessing tech

Use of technology could cushion agriculture sector from the impact of climate change

By Audrey Tan, Science and Environment Correspondent, The Straits Times, 17 Feb 2021

Some $60 million will be set aside for a new fund to help farmers better harness technology in local food production, Deputy Prime Minister Heng Swee Keat said yesterday.

"Technology is a game changer and will open new possibilities. We harnessed technology to overcome our water and land constraints, and will do the same for climate change," he said.

The symptoms of climate change include more frequent extreme weather events, which could disrupt global supply chains and threaten global food production.

But the use of technology could cushion the agriculture sector from erratic rainfall patterns and climbing temperatures.

The new fund, called the Agri-Food Cluster Transformation Fund, will replace the existing Agriculture Productivity Fund, said Mr Heng, who is also the Finance Minister.

The Agriculture Productivity Fund is administered by the Singapore Food Agency and was set up in 2014 to help farmers boost yields and increase production capabilities.

More details on the new fund will be announced by the Ministry of Sustainability and the Environment (MSE) during the debate on its budget, said Mr Heng.

The Singapore Food Agency is an agency under MSE.

In his speech, Mr Heng cited Eco-Ark, a high-tech fish farm off the Changi coast. Eco-Ark is a floating fish farm built by the Aquaculture Centre of Excellence with funding support from the Agriculture Productivity Fund.

"With advanced aquaculture technologies, Eco-Ark is able to produce 20 times more output than the average in coastal fish farms. This improves our food resilience, as part of the 30-by-30 goal," Mr Heng said.

This 30-by-30 goal refers to Singapore's target of producing 30 per cent of its nutritional needs through locally farmed food by 2030 - up from less than 10 per cent today.

The offshore farm, with a total capacity of 96 tonnes, is able to produce 166 tonnes of fish a year - about 20 times more than the minimum level set for coastal fish farms in Singapore.

Unlike a typical kelong where fish are reared in open-net cage-farming systems exposed to the open sea, the fish at the Eco-Ark swim in tanks isolated from the currents.

This means the fish - which include species such as barramundi, red snapper fingerlings and groupers - are safe from threats of open-cage farming, such as oil spills as well as plankton blooms, which, by depleting water of oxygen, caused massive fish deaths in 2014 and 2015.

Noting that sustainability is a journey, not a destination, and that technology would advance over time, Mr Heng said: "Costs and benefits of projects will change, as climate cost is factored in and as technology advances.

"We must continue to stay open and adaptive, and carefully balance our development objectives with sustainability considerations."

Professor William Chen, the Michael Fam Chair professor in food science and technology at Nanyang Technological University, said that while government funding support was important in getting farmers to adopt technology, other factors - such as consumers' receptivity to local produce - were also crucial.

But he added that the renaming of the fund to include agri-food instead of just agriculture could mean that less conventional types of technology, such as farming insects for food, or cultivating meat in bioreactors, could be eligible for funding.

"This much broader scope is better aligned with Singapore's 30 by 30 goal. Taken together, we should see more food sources for greater food security in Singapore," he said.

Petrol duties raised for first time in six years

Motorists will be given rebates on road tax and additional petrol duty to help offset the pump hike of up to 23%

By Choo Yun Ting, The Straits Times, 17 Feb 2021

Motorists will now have to pay more at the pump, as petrol duties were raised for the first time in six years yesterday.

Announcing the hike which took immediate effect, Deputy Prime Minister Heng Swee Keat said motorists will be given road tax and additional petrol duty rebates to help offset the higher costs.

The duty for premium grade (98-octane and above) petrol will be raised by 15 cents a litre to 79 cents a litre - a 23 per cent increase.

The duty for intermediate grade (92-octane and 95-octane) petrol will be raised by 10 cents a litre to 66 cents a litre, an 18 per cent hike.

Petrol duties were last raised in 2015 - by 20 cents a litre for premium grade petrol and 15 cents a litre for intermediate grade petrol - to encourage less car usage and reduce carbon emissions.

Mr Heng said the higher petrol duties are meant to encourage Singaporeans to reduce their vehicle usage as part of the country's broader sustainability push, which includes measures to promote early adoption of electric vehicles.

Most of the expected revenue increase from the petrol duties will be given out through rebates for petrol and petrol-hybrid vehicles, he said, adding that around $113 million has been set aside to cushion the hike.

Motorcycles will get a 60 per cent road tax rebate for a year. Those who own bikes with an engine capacity under 400cc will get up to $80 of additional petrol duty rebate, depending on the engine capacity.

Taxis and private-hire cars will be given a 15 per cent road tax rebate for a year and $360 of additional petrol duty rebate over four consecutive months for ac-tive drivers.

Goods vehicles and buses will be given a 100 per cent tax rebate for a year, while cars using petrol will be given a one-year tax rebate of 15 per cent.

All road tax changes will apply for a one-year period from Aug 1 this year to July 31 next year.

For example, the owner of a mass-market sedan such as a 1,598 cc Hyundai Avante with a fuel consumption of 5.4 litres/ 100km would pay about $631 in road tax for the one-year period from Aug 1, as compared with the usual $742 a year - some $111 in savings.

Assuming that the vehicle uses intermediate grade petrol and clocks an annual mileage of 20,000km, the car owner's additional fuel cost would be around $110, which would be offset by the road tax rebates for the year.

Both road tax and additional petrol duty rebates will be disbursed automatically to eligible recipients. The Land Transport Authority will release further details on the additional petrol duty rebates in April.

The rebate measures will help offset one year of petrol duty increases for taxis and motorcycles, and about two-thirds of petrol duty increases for commercial vehicles and cars, said Mr Heng.

In a Facebook post, he said raising petrol duty rates was one of the hard choices that had to be made in this year's Budget.

The move builds on Singapore's efforts over the years to reduce vehicular emissions, he said, adding: "The reality is that combating climate change will require difficult trade-offs in the years ahead."

Motorcycle owner Muhammad Irsyad, 22, said raising petrol duties during the pandemic was harsh. "I can't say I am not affected, but I would probably feel its impact only in the long run," the full-time national serviceman added.

Marketing executive Cheryl Phua, 57, said the higher petrol duties may factor into her decision to switch to a more fuel-efficient vehicle. "Since petrol prices would be higher, I think I would consider a hybrid car for my next vehicle."

Associate Professor Simon Poh of the National University of Singapore's business school noted that sustainability is emerging as one of the Government's long-term goals. "Hiking the petrol duty to discourage car usage and encourage drivers to switch to electric cars helps to promote a green environment. This is in line with Singapore's intention to cooperate with other countries in combating climate change," he said.

Additional reporting by Deepa Sundar

Cost of owning electric vehicles to be lowered to boost early adoption

By Toh Ting Wei, The Straits Times, 17 Feb 2021

More measures will be rolled out to narrow the cost of owning an electric vehicle (EV) compared with petrol and diesel vehicles to encourage drivers to make the switch.

Deputy Prime Minister Heng Swee Keat said yesterday that the minimum Additional Registration Fee (ARF) for electric cars will be lowered to zero from January next year to December 2023.

Currently, all car buyers have to pay at least $5,000 in ARF, regardless of the tax rebate a car is entitled to. Based on current prices, the change would see tax rebates fully cover the ARF of the Renault Zoe and MG ZS electric cars.

Mr Heng said lowering the ARF floor will enable mass-market electric car buyers to maximise tax rebates from the Electric Vehicle Early Adoption Incentive.

Road taxes for electric cars will also be revised such that a mass-market electric car will have a road tax comparable with that of an internal combustion engine equivalent, Mr Heng added.

More details will be announced when MPs debate the budgets of various ministries from next week.

These moves are the latest in a series of measures by the Government to speed up the phasing out of vehicles running purely on fuels here.

As part of the inter-ministerial Singapore Green Plan 2030 announced last Wednesday, the Government said it would revise Singapore's multi-layered vehicle tax structure to "make it easier to buy and own" EVs.

EV incentives were enhanced just last month, when bigger rebates under the Vehicular Emissions Scheme as well as the Electric Vehicle Early Adoption Incentive kicked in. Together, they give an electric car buyer as much as $45,000 in tax breaks.

The road tax formula was also revised to make it less onerous for electric car owners.

In terms of infrastructure, the Government will more than double the targeted number of public EV charging points, from 28,000 to 60,000 by 2030.

Mr Heng said yesterday that $30 million will be set aside over the next five years for initiatives related to EVs, such as measures to increase the number of charging points at private properties.

The various measures will help reshape Singapore's transport footprint towards cleaner transport, he added.

Mr Raymond Tang, managing director of Yong Lee Seng Motor, welcomed the measures. But he hopes more can be done to promote the financial and environmental benefits of EVs.

"Customers do not know how it is better than conventional vehicles and they are also worried about whether they can find enough charging points," he said.

"It is hard for dealers to bring in EVs if there is no demand."

Managing our finances: Singapore to draw on reserves for 2nd year to fight COVID-19

$1.7 billion will be combined with unused $9.3 billion from 2020 to fund relief measures

By Tham Yuen-C, Senior Political Correspondent, The Straits Times, 17 Feb 2021

For a second year in a row, Singapore will dip into its past savings to pay for measures needed to fight Covid-19, with a draw of $1.7 billion on the reserves.

The amount will be combined with $9.3 billion that was drawn last year but not used, with all $11 billion going towards funding the Covid-19 Resilience Package.

Altogether, the expected draw on the reserves over the two financial years will come up to a total of $53.7 billion.

Announcing this in his Budget statement yesterday, Deputy Prime Minister Heng Swee Keat said running a fiscal deficit to support targeted relief was warranted in the immediate term.

Even as Singapore's economy reopens, there are badly hit sectors like aviation that are still in the doldrums and segments of society that still need help.

At the same time, public health measures have to continue in the global battle against Covid-19, with success uncertain.

Explaining the decision to fund the Covid-19 Resilience Package by tapping the reserves, Mr Heng noted that the measures were extraordinary and temporary.

He said: "This is the second consecutive financial year where we will be drawing on our past reserves. This is necessary, given the exceptional circumstances we are in.

He also said that President Halimah Yacob has given her in-principle support for the move.

In a Facebook post yesterday, Madam Halimah said Mr Heng briefed her and the Council of Presidential Advisers last month.

She said she agreed with the Government's proposal, given the exceptional circumstances, and had approved, in principle, the use of $11 billion from the reserves to fund the short-term relief measures.

"After Parliament has debated the Budget, I will formally consider the proposal before giving my assent to the Supply Bill," she said.

"The road ahead is going to be challenging and uncertain. We must remain resolute in our fight against Covid-19.

"At the same time, the post-Covid-19 world presents us with new opportunities in innovation and transformation. How we continue to respond to the crisis will determine our future."

Over five Budgets last year, the Government had proposed a draw of up to $52 billion on the reserves to tackle the challenges brought by Covid-19, but used only $42.7 billion.

Mr Heng said that as people and businesses here had adapted effectively to the situation, the Government was able to bring the pandemic largely under control and did not need to spend as much on some of the public health measures as it had anticipated.

Casting his gaze ahead, he said the Government's priorities in the medium to long term are to invest strategically for growth, press on with economic transformation and lay the groundwork to position Singapore for the future.

He reiterated the need to balance between immediate and long-term needs, making it clear that Singapore would have to return to running balanced Budgets beyond the current crisis.

"It was fiscal prudence and discipline that allowed us to accumulate our national reserves, which has enabled us to respond decisively to this crisis," he said.

He noted that Singapore's recurrent spending needs had already been going up before Covid-19 hit, and that the fundamental drivers of these fiscal trends have not changed.

They include an ageing population, maturing society, and growing healthcare and social spending.

Stressing the importance of meeting such structural needs in a disciplined and sustainable way, he said: "Our fiscal approach must strike a careful balance between addressing our immediate needs and meeting our longer-term structural needs in a responsible manner."

Expansionary Budget set to run up deficit of $11 billion

By Choo Yun Ting, The Straits Times, 17 Feb 2021

The Budget will continue to be expansionary for financial year 2021, with an expected deficit of $11 billion, or 2.2 per cent of Singapore's gross domestic product.

This is because an $11 billion Covid-19 Resilience Package has been marshalled to tide Singaporeans and businesses over the coronavirus pandemic, said Deputy Prime Minister Heng Swee Keat yesterday.

Last year's expansionary Budget is expected to result in Singapore's largest deficit since independence, with an overall deficit of $64.9 billion, or 13.9 per cent of gross domestic product.

"The deficit is driven by lower revenues due to dampened economic activity and the significant expenditures needed to mount a decisive response to Covid-19," said Mr Heng, who is also Finance Minister.

Measures rolled out in this year's Budget will help Singapore emerge stronger, by pressing on with economic and workforce transformation, strengthening its social compact and building a sustainable future for its people, and will impart a considerable fiscal boost to the economy, he added.

REVENUE AND EXPENDITURE FOR 2021

Revenue for this year is projected to hit $76.6 billion, which is $12 billion or 18.6 per cent more than the previous year's revised estimates.

This is largely due to higher corporate income taxes, goods and services tax and other taxes such as foreign worker levies. But this increase will be moderated by lower personal income taxes.

Betting taxes are expected to go up by about 30 per cent to $2.4 billion.

Meanwhile, the ministries' expenditures are projected to come in at around $102.3 billion, some $8.3 billion or 9 per cent higher than revised 2020 estimates.

This is largely due to heavier spending on healthcare, transport and defence, which is partly offset by lower trade and industry spending as well as national development expenditures.

Transport spending will go up by $3 billion, or 37.8 per cent, with the resumption of construction activities and higher provisions for Covid-19 relief measures, especially for the hard-hit aviation sector, which will receive additional support and extended cost relief amounting to around $870 million.

In addition, healthcare spending will also go up, mainly due to the growth in patient subsidies with the opening of new facilities, ramping up of capacity ahead of the opening of the Woodlands Health Campus, and increasing demand for health and aged care services as Singapore's population ages.

On the flip side, trade and industry spending is expected to come down with the tapering off of economic relief measures.

BOOST FROM NET INVESTMENT RETURNS

The Net Investment Returns Contribution (NIRC) continues to be the largest contributor to government coffers, and is expected to bring in some $19.6 billion this year - a 7.8 per cent increase over last year.

The returns from Singapore's invested reserves have been the single largest source of government revenue since 2016, outweighing tax revenue sources such as corporate and personal income taxes and the goods and services tax.

The NIRC comprises up to 50 per cent of the net investment returns on net assets invested by the Monetary Authority of Singapore, GIC and Temasek, the three entities which manage and invest Singapore's reserves, and up to 50 per cent of the net investment income derived from past reserves from the remaining assets.

* Ask the Finance Minister: Singapore hopes to balance its Budget as economy picks up

DPM Heng says economy likely to gain strength this year with vaccinations on globally

By Choo Yun Ting, The Straits Times, 22 Feb 2021

Singapore has a good chance of balancing its Budget during this term of government if economic recovery goes as expected, said Deputy Prime Minister Heng Swee Keat yesterday.

He noted that the trajectory of the recovery will depend on the course of the pandemic, but with vaccination exercises taking place globally, there is hope for the economy to gain strength this year.

The Government hopes to balance its Budget over the next four to five years especially since it has drawn significantly on past reserves - a total of $53.7 billion since last year, said Mr Heng, who is also Finance Minister. "But I'm hoping that as businesses resume, as income resumes, we can get back to a balanced budget," he added.

After having to present five Budgets last year as the pandemic unfolded, he hoped he would have to do only one this year, which would be a sign the situation has stabilised. But the Government is ready to react should there be a need to, he said.

Speaking on a Channel 5 programme, Mr Heng addressed questions on this year's Budget, focusing on themes such as Singapore's green ambitions and support for businesses and workers.

Increasing the goods and services tax (GST) rate from 7 per cent to 9 per cent will support government revenues in the coming years, especially as recurrent spending in areas like healthcare is expected to go up as the population ages, he said.

In his Budget speech last Tuesday, Mr Heng said the GST hike will take place between next year and 2025, and sooner rather than later.

Last night, he reminded Singaporeans of measures in place to cushion the impact of this hike, citing the $6 billion Assurance Package committed in Budget 2020, that would see adult Singaporeans receiving cash payouts of between $700 and $1,600 over five years.

Singapore's system of taxes and benefits is a progressive one, Mr Heng added, citing how last year, the top 20 per cent of Singaporean households paid 56 per cent of taxes and received 11 per cent of benefits, while the lowest 20 per cent of households paid 9 per cent of taxes and received 27 per cent of the benefits.

"Our system has been designed over the years to tilt our support... to those with greater needs, and we continue to observe this principle," he said. He added that income inequality measured by the Gini coefficient, which the Government has been tracking since 2000, was at a historic low last year due to massive transfers.

Mr Heng also highlighted how rebates will help offset the costs motorists will incur with the recent petrol duty hike. Those who rely on their vehicles for a living get rebates which are equivalent to not paying the rise in petrol duty for a year, while other motorists will get support equivalent to about two-thirds of their expected rise in cost.

Mr Heng said Singapore and its people must always be prepared for change, but said that the future is full of promise.

"What we must do is to come together, put our minds together, our hearts together, our hands together and say, well, how do we work together to seize these opportunities," he said.

"There will be many, many new opportunities that will come out of this pandemic, and Singapore is in a very good position to do that."

Singapore's progressive wage model sustainable, has worked well: DPM Heng

By Choo Yun Ting, The Straits Times, 22 Feb 2021

Singapore's progressive wage model is a sustainable one which has worked well, said Deputy Prime Minister Heng Swee Keat in highlighting the importance of getting various parties to work together to roll it out to more sectors.

He was speaking during a panel discussion on the Budget, in response to a union leader's wish for the model - which sets out a wage ladder and training requirements for lower-paid workers at different skill levels - to be put in place across other industries more quickly.

"We can get everyone, companies, workers, the unions, the Singapore National Employers Federation, to all work together so that we can make the change," said Mr Heng to fellow panellist K. Thanaletchimi during the one-hour Channel 5 programme.

The model will be discussed in detail during the debate on the ministries' budgets, he added.

It is currently mandatory in the cleaning, landscaping and security sectors, covering some 80,000 workers, and will be extended to the lift and escalator maintenance sector next year. The labour movement has been pushing to expand the model to more sectors.

Mr Heng noted that helping workers move into new jobs is a major part of this year's Budget, especially as the global economy evolves and jobs change.

Emphasising the Budget's objective in helping Singapore emerge stronger from the Covid-19 crisis, he said the Jobs Growth Incentive - which $5.2 billion has been allocated to this year - is part of efforts to help businesses transform, noting that a productive new hire could add to the company's revenue and justify the hiring.

"We are using this time to really accelerate that hiring so that companies which have confidence that (they) can continue growing can hire, and their growth is not impeded during these next few months," he said.

Some $24 billion will be allocated over the next three years to accelerate economic transformation, by supporting firms and workers.

Mr Heng also highlighted how workers will be given support to take on jobs in growth areas like the urban solutions and sustainability sector - one of the areas of focus in Singapore's Research, Innovation and Enterprise 2025 plan.

There are many green shoots in research and development in this sector, he said, adding that some of Singapore's companies are doing well in areas such as carbon sequestration and reducing waste.

"If Singapore can do it, the solutions that we find will also be valuable to many cities around the world," he said. "And in that way, it can keep our businesses and workers competitive."

During the programme, Mr Heng also discussed support for households and more vulnerable groups.

Addressing concerns about support for employees' mental well-being, he said there are work groups tackling issues of mental wellness among groups such as workers and students.

"I hope that employers can play a more proactive role to ensure the mental well-being of our workers," he said, urging Singaporeans to come together to see how the problems can be addressed.

Related

No comments:

Post a Comment